Releasing InvestOS v0.3

Welcome to Weekly Roundup #7 at ForecastOS! We're glad to have you here, following our journey :)

Thoughts, Musings, and Updates

Releasing InvestOS v0.3

Over the last few weeks, a few professional investors have become interested in our opinionated framework for constructing and backtesting portfolios: InvestOS.

We've helped them get started, and in doing so, found and fixed a couple design flaws.

The result is InvestOS v0.3. A de-coupled and improved framework.

This work also yielded 13 friendly guides for using InvestOS, covering:

- Installation of the open-source module,

- how the framework works,

- running a simple rank long / short backtest, and

- creating custom constraint models for convex portfolio optimization.

Check them out and let us know what you think. We think we're on to something!

Noodling on Vacation Policy

As an ex-investment-banker turned software engineer turned quantitative investor turned founder, I have a complicated relationship with hard work, time off, and what level of #riseandgrind I should encourage.

While I'm happiest hard at work, I also have first-hand experience with how quickly productivity can rise (from much needed rest) and fall (from late nights).

All this is to say: I've settled on four weeks vacation at InvestOS. Three of which will be elective, one of which will be mandated for all employees over the December holidays. I also plan to sprinkle in a few company-wide days off around long-weekends throughout the year, making the total ~4.5 weeks per year.

Is this too much, or too little? What do you think the right balance is?

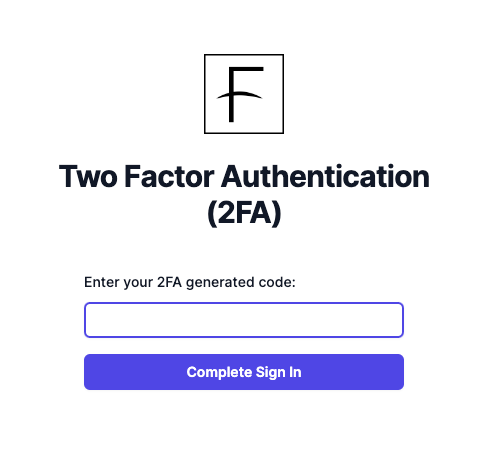

Two Factor Authentication

We've decided to make two factor authentication mandatory for all users of ForecastOS.

We built and shipped this functionality last week; for those of you that are users, you'll be prompted (i.e. politely forced) to set it up when you log in next!

You Can't Get What You Don't Ask For

I find the FX rates that banks charge small businesses infuriating. They often quote a ~6% spread, although they will offer you a slightly less egregious deal immediately - as if they are doing you a huge favour.

While at the bank most recently, I (as politely as I could) made the teller aware that I knew the current FX rate, and asked how close they could get to the live market rate quoted on InteractiveBrokers.

I then learned that many retail banking locations have the authority to offer you within (in this case, exactly) 25bps of the spot FX rate, despite often starting at ~300bps from spot. If you're in a pinch, or not converting a huge amount, 25bps is a small price to pay for convenience. All you have to do is ask!

Work: What Got Done

ForecastOS is a new startup. As such, we try to spend 100% of our time either building or selling. We log that effort here.

This past week, as it pertains to selling, we:

- Continued the outreach process for our unified AI management (AIM) and backtesting platform; if you know anyone we should talk to, please let us know! We have capacity to onboard 1 additional client in Q1 2024

This past week, as it pertains to building, we:

- Helped an InvestOS open-source user build and backtest a quant portfolio

- Added mandatory two-factor authentication

- Released 13 guides for InvestOS

- Released InvestOS v0.3

Other notable activities from this past week:

- Set up payroll

Work: What's Coming Next

It's important to keep velocity high. We keep ourselves accountable by sharing what we hope to finish over the next week.

This week we will:

- Build and release a risk model for InvestOS convex portfolio optimization

- Continue outreach for our unified AI management (AIM) and backtesting platform

- Build, and prepare to deploy, v1 of our open-source (PyPI) package and associated API for consuming features and datasets through ForecastOS in less than 10 lines of code

- Continue planning our first (financial) forecasting competition

Until next week!